In 2023, Vietnam’s tea exports saw a decline in both volume and value, reaching 121 thousand tons valued at 211 million USD, down 16.9% in volume and 10.9% in value compared to 2022. The average export price of tea reached 1,737.3 USD/ton, an increase of 7.3% from 2022.

Table of Contents

Pakistan: Largest Tea Export Market Faces Sharp Decline

In 2023, Pakistan remained Vietnam’s largest tea export market, accounting for 39% of the total tea export value. However, tea exports to Pakistan dropped by 16.1% in volume and 18.4% in value compared to the same period in 2022. The main cause was the unstable economic situation in Pakistan.

Taiwan: Second Largest Tea Export Market Shows No Significant Growth

Taiwan is Vietnam’s second-largest tea export market, making up 11% of the total tea export value. However, tea exports to Taiwan are declining due to competition from other countries and changing consumer habits.

Russia: Traditional Tea Export Market Faces Many Fluctuations

Russia is a traditional tea export market for Vietnam, accounting for 5% of the total tea export value. However, tea exports to Russia are facing difficulties due to economic and political instability.

EU: Potential Tea Export Market Yet to be Effectively Exploited

The EU is the world’s largest tea import market, but Vietnam only accounts for 0.22% of the EU’s total tea import value. The EVFTA agreement has brought many tariff incentives for Vietnamese tea, but technical barriers remain a significant challenge.

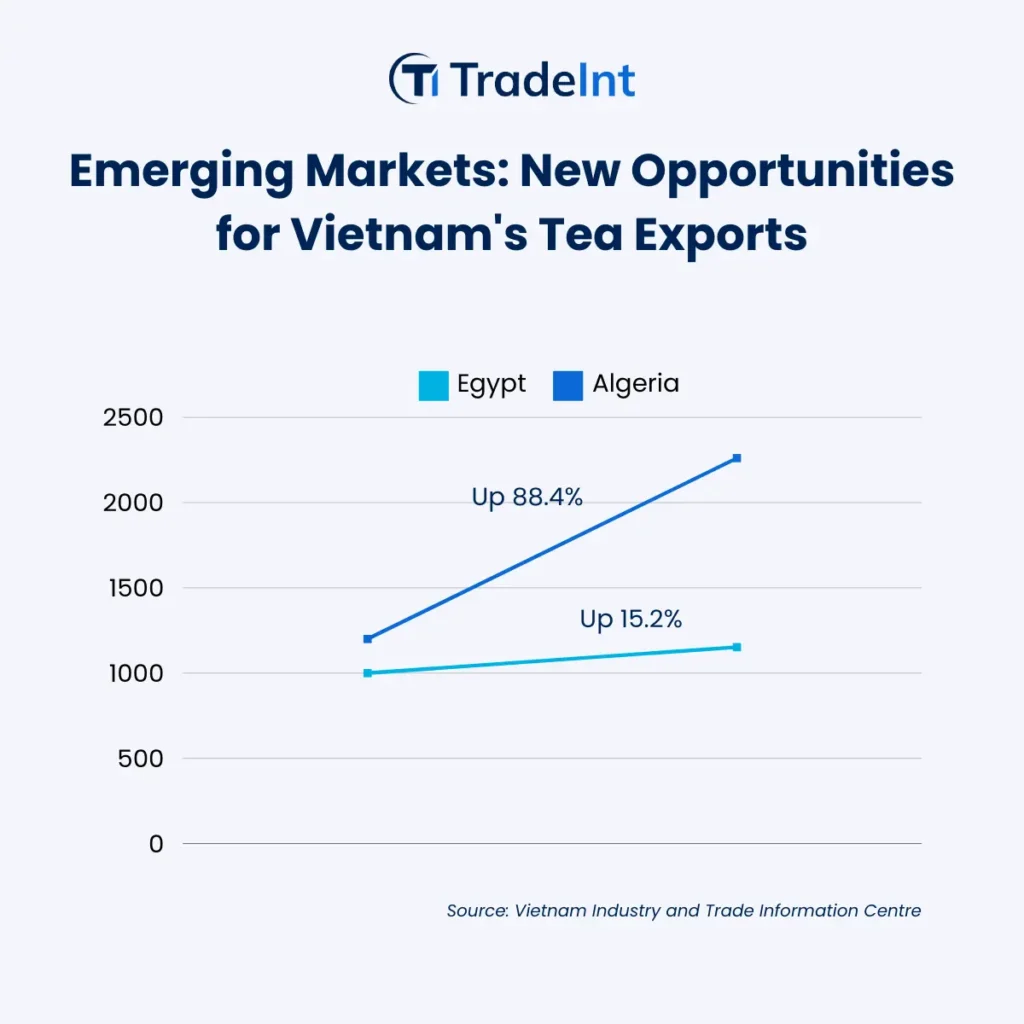

Emerging Markets: New Opportunities for Vietnam's Tea Exports

Besides traditional markets, Vietnam is seeking opportunities in new tea export markets such as the Middle East, North Africa, and Eastern Europe. Some emerging markets have shown promising signals, such as Egypt (up 15.2%) and Algeria (up 88.4%).

Conclusion

2023 was a challenging year for Vietnam’s tea exports. However, by seeking and expanding into new markets, Vietnam’s tea industry still has growth potential. To effectively exploit these markets, the tea industry needs to focus on improving product quality, building brands, and diversifying products, especially green tea, black tea, and flavored tea. Additionally, investing in deep processing and developing high value-added tea products is also an important direction to enhance the competitiveness of Vietnam’s tea industry in the international market.

Learn more about

Vietnam Trade Coverage

To learn more about the topics discussed in this blog post, you can explore the following additional resources:

- Unveiling the Superiority of TradeInt over Panjiva: A Comprehensive Comparison

- Unveiling the Superiority of TradeInt over MarketInsideData: A Comprehensive Comparison

- Unveiling the Superiority of TradeInt over TenData: A Comprehensive Comparison

- What is Trade Data? Understanding Import and Export Data

- Unlocking Trade Insights with Mirror Data

- Understanding the Legality of Trade Data Platforms

- Trade Data Confidentiality: Understanding TradeInt’s Approach

- Understanding Trade Data Discrepancy: Causes and Implications

- TradeInt Online Trade Database Platform Release

- Trade Intelligence Global Pte Ltd: Innovative Global Trade Services

- Navigating the World of Customs Data: A Comprehensive Guide

About Trade Intelligence Global Pte. Ltd.

Trade Intelligence is a distinguished leader in global trade solutions, delivering exceptional results for businesses worldwide. With a focus on excellence, innovation, and client success, Trade Intelligence Global empowers businesses to thrive in today’s interconnected global economy. To find out more, visit https://tradeint.com.