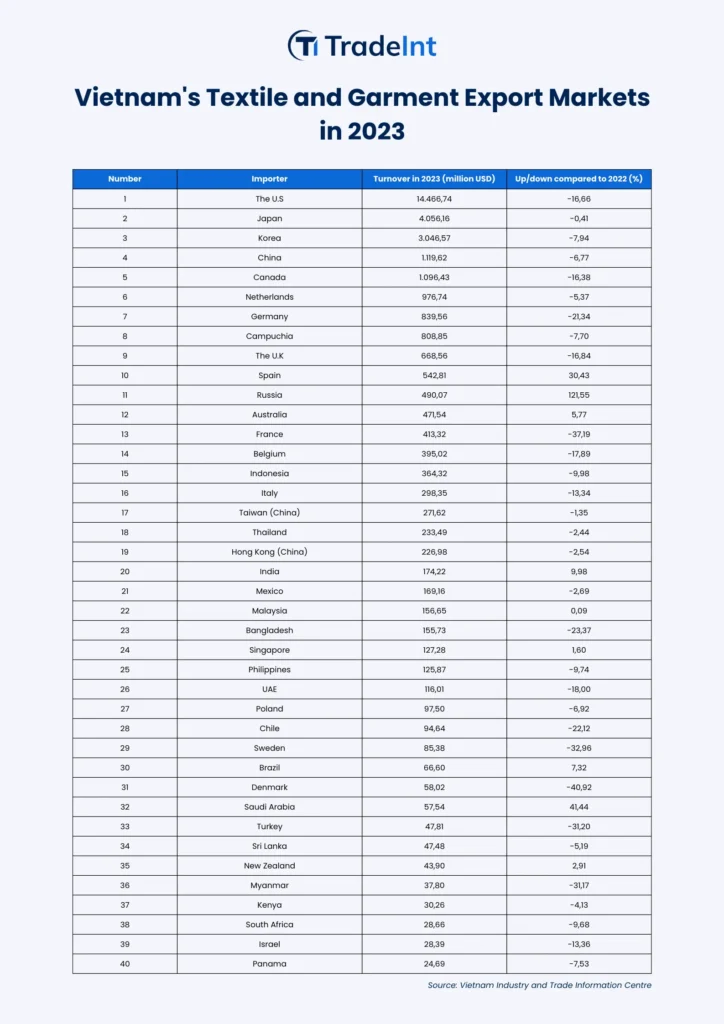

Vietnam’s textile and garment exports in 2023 reached $33.3 billion, down 11.4% from the previous year. However, the industry showed signs of recovery in the second half of the year. Let’s take a look at Vietnam’s main and potential textile and garment export markets in 2023.

Table of Contents

United States: Largest Market but Slowing Down

The United States remains Vietnam’s largest textile and garment export market, accounting for 43.4% of total export revenue. However, exports to this market fell by 16.7% compared to 2022, reaching $14.5 billion. The main reason is inflation in the United States, which has reduced purchasing power.

EU: Potential Market with Many Challenges

The EU is Vietnam’s second-largest textile and garment export market, accounting for 22.5% of total export revenue. However, exports to this market also fell by 14.1% compared to the previous year. Several EU markets, such as the UK, Finland, Norway, France, and Denmark, recorded significant declines.

Japan: Stable Market with Many Challenges

Japan is Vietnam’s third-largest textile and garment export market, accounting for 12.2% of total export revenue. Exports to this market decreased slightly by 0.4% compared to 2022, indicating stable demand for textiles and garments in Japan.

South Korea: Slower Growth

South Korea is Vietnam’s fourth-largest textile and garment export market, accounting for 9.1% of total export revenue. Exports to this market fell by 7.9% compared to 2022.

Emerging Markets: New Opportunities

In addition to traditional markets, Vietnam is also boosting textile and garment exports to emerging markets such as Russia, Saudi Arabia, Spain, Australia, and India. These potential markets can help offset the decline in traditional markets.

List of Vietnam's Textile & Garment Export Markets in 2023

Below is a list of countries importing textiles and garments from Vietnam in 2023:

Conclusion

2023 was a challenging year for Vietnam’s textile and garment industry, but it also opened up new opportunities in emerging markets. With the efforts of businesses and government support, Vietnam’s textile and garment industry is expected to continue to grow and assert its position in the international market.

Learn more about

Vietnam Trade Coverage

To learn more about the topics discussed in this blog post, you can explore the following additional resources:

- Unveiling the Superiority of TradeInt over Panjiva: A Comprehensive Comparison

- Unveiling the Superiority of TradeInt over MarketInsideData: A Comprehensive Comparison

- Unveiling the Superiority of TradeInt over TenData: A Comprehensive Comparison

- What is Trade Data? Understanding Import and Export Data

- Unlocking Trade Insights with Mirror Data

- Understanding the Legality of Trade Data Platforms

- Trade Data Confidentiality: Understanding TradeInt’s Approach

- Understanding Trade Data Discrepancy: Causes and Implications

- TradeInt Online Trade Database Platform Release

- Trade Intelligence Global Pte Ltd: Innovative Global Trade Services

- Navigating the World of Customs Data: A Comprehensive Guide

About Trade Intelligence Global Pte. Ltd.

Trade Intelligence is a distinguished leader in global trade solutions, delivering exceptional results for businesses worldwide. With a focus on excellence, innovation, and client success, Trade Intelligence Global empowers businesses to thrive in today’s interconnected global economy. To find out more, visit https://tradeint.com.